Closely Held Business Stock

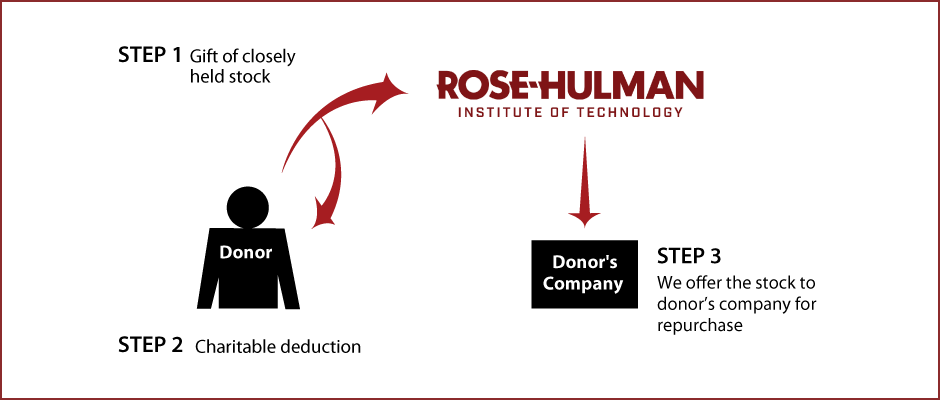

How It Works

- You make a gift of your closely held stock to Rose-Hulman Institute of Technology and get a qualified appraisal to determine its value

- You receive a charitable income-tax deduction for the full fair-market value of the stock

- Rose-Hulman Institute of Technology may keep the stock or offer to sell it back to your company

Benefits

- You receive an income-tax deduction for the fair-market value of stock

- You pay no capital-gain tax on any appreciation

- Your company may repurchase the stock, thereby keeping your ownership interest intact

- Rose-Hulman Institute of Technology receives a significant gift

More Information

REQUEST AN eBROCHURE

WHICH GIFT IS RIGHT FOR YOU?

CONTACT US

Cora Griffin Grounds |

Rose-Hulman Institute of Technology |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer