Bill Blount’s “Trust” in Rose-Hulman Benefits His Family Too

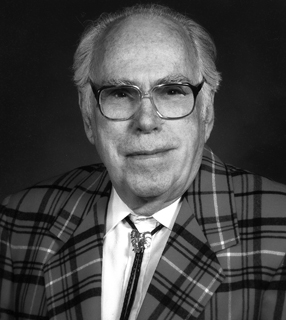

Bill Blount ’48 |

Bill Blount ’48 was always proud of his alma mater. His gift to Rose-Hulman is supporting the school and helping his daughters as well.

Bill earned a bachelor of science degree in mechanical engineering here and worked at General Electric Company in Newark, New Jersey. He retired as employee and community relations supervisor and moved back to his native Texas.

In 1997, Bill set up a charitable remainder trust with Rose-Hulman in honor of his daughters, Nancy and Barbara. “I chose this type of gift because it was a good way to get money to the school and my daughters currently receive money from the charitable remainder trust,” Bill said.

A charitable remainder trust is an irrevocable trust that provides for two sets of beneficiaries. One set is the income beneficiaries—in this case, Bill’s daughters—who receive a set percentage of income from the trust for life. The other is Rose-Hulman, which will receive the remaining trust assets after the income beneficiaries pass away.

Because their assets are destined for charity, charitable remainder trusts avoid capital-gain tax. An ideal way to fund them is with highly appreciated stocks or property that you have owned for some time. You also receive a charitable income-tax deduction for this gift.

Bill earmarked his trust to help deserving students. “I’m glad the fund will ultimately benefit scholarship funds at Rose,” he said.

Because of the size of his gift, Bill became a Fellow of the Chauncey Rose Society. The organization recognizes donors who share the foresight, dedication, and generosity of Rose-Hulman founder Chauncey Rose.

Bill established his trust at the age of 77. Have you made a similar commitment to your family and Rose-Hulman? Consider the possibilities.

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer